When welcoming the reader, it’s worth immediately grabbing their attention with a surprising twist: Versace’s valuation dropped by nearly 40% between 2018 and 2025—from around USD 2.15 billion to approximately EUR 1.25 billion (about USD 1.38 billion). It’s a sobering lesson in how even iconic fashion houses can lose value in an unstable market environment.

Who owns the Versace fashion house?

A brief media anecdote will help build a bridge to a deeper analysis. Imagine headlines from a few months ago: “Prada acquires Versace for a symbolic price”—it sounds dramatic, but captures the essence. At this point, the question “Who really stands behind Medusa today?” is not purely rhetorical—it opens the door to further exploration of the topic.

This section introduces three main themes that will be further developed in the article:

- history of ownership changes, from Gianni Versace to Capri Holdings and ultimately the Prada group;

- current condition of the brand – particularly financial problems, declining sales, and integration challenges;

- future outlook, including Prada’s strategy, growth plans, and safeguarding Versace’s identity.

From Gianni to the Prada Group – the ownership journey of Versace

In the following paragraphs, readers will discover how Versace navigated its path among global fashion empires, what exactly led to its weakened position, and how Prada plans to seize this opportunity to restore the Medusa legend’s former glory. A new chapter is just beginning—which is why it’s worth staying tuned.

History and ownership changes

Below is the proposed content in Polish as per the requirements:

Brief introduction:

The Versace brand has undergone several significant ownership changes since its founding in 1978. This section of the article will present a chronological overview of the most important ownership transitions, highlighting the business motives and their consequences. Tracing these events helps to understand how past decisions have shaped the current state of the fashion house.

Chronological table

| Year | Event | Meaning |

|---|---|---|

| 1978 | The founding of the brand by Gianni Versace – opening the first on Via della Spiga | The beginning of a global legacy; the foundation of the brand’s identity and luxurious image |

| 15/07/1997 | The murder of Gianni Versace | A dramatic turning point; handing over the reins to the family – Donatella and Santo Versace |

| 2018 | Sale of Versace to Capri Holdings for $2.1 billion (~€1.83 billion) | Capital injection for further growth; consolidation within a larger conglomerate |

| 10/04/2025 | Acquisition by Prada Group for EUR 1.25 billion (Enterprise Value) | A fresh start under an Italian luxury group; price about 40% lower than in 2018; opportunity for revitalization |

Key moments and their significance

Founding and Initial Expansion (1978)

Gianni Versace opened his first boutique on Via della Spiga in 1978, marking the birth of one of Italy’s most iconic luxury brands. This laid the foundation for the creativity, extravagance, and global reach that the brand would continue to cultivate over the following decades.

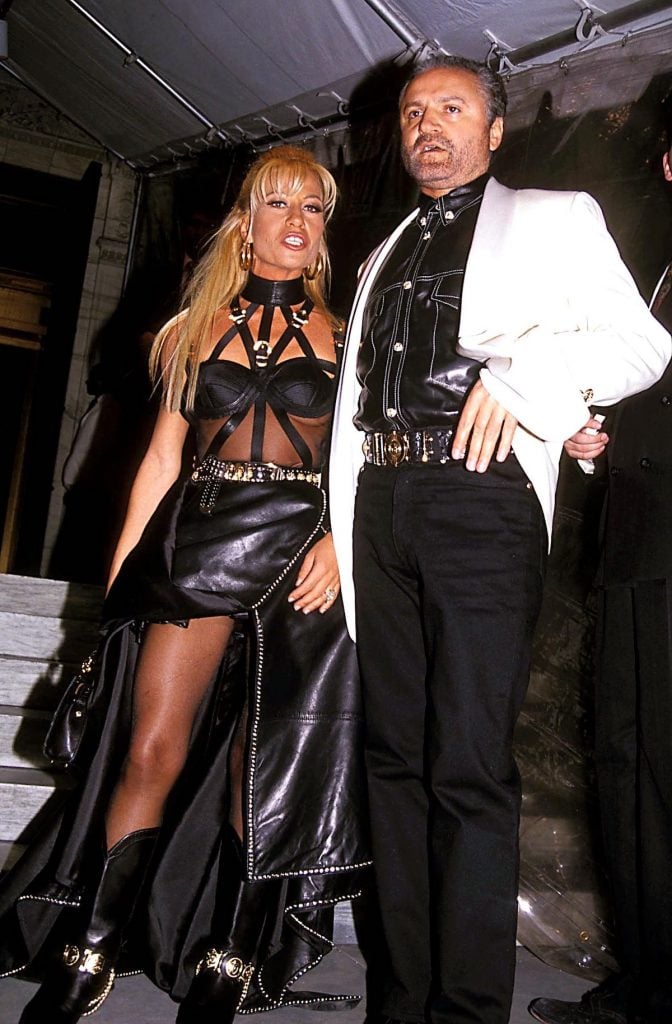

Trauma and a New Chapter (1997)

On July 15, 1997, the tragic murder of Gianni Versace forced the family to take over the management of the brand. Donatella and Santo Versace took the helm of the fashion house, introducing a new dynamic—they preserved its legacy but also had to face market challenges.

Capri Holdings entry (2018)

In 2018, the brand was sold to Capri Holdings (formerly Michael Kors Holdings) for USD 2.1 billion (~EUR 1.83 billion). This strengthened its financial structure and global presence, although it also meant the loss of the brand’s family independence.

Acquisition by Prada Group (2025)

On April 10, 2025, Prada Group signed an agreement to acquire Versace for EUR 1.25 billion (Enterprise Value), which is approximately 40% lower than the amount in the 2018 transaction. This difference may have been caused by declining Versace sales, market changes, and Capri Holdings’ desire to consolidate capital.

Final observation

This story illustrates how pivotal events—from the founder’s tragic death to strategic investment moves—have shaped the fate of the Versace fashion house. Each change in ownership stemmed from financial needs, the desire to protect its legacy, or responses to market dynamics. This perspective reveals how international decisions have influenced the brand’s standing.

Current status and ownership structure

The presented excerpt focuses on the current ownership structure of the Versace brand following its acquisition by the Prada Group. It provides the latest “here and now” status, taking into account the ownership structure, the influence of the Versace family, operational data, and the practical implications of this new configuration.

The new owner has taken full control of Versace, opening a new chapter in the brand’s history.

Key owner and management structure

In April 2025, Prada Group signed a definitive agreement to acquire 100% of the shares in Versace from Capri Holdings—the deal valued the enterprise at approximately 1.25 billion EUR). The brand will remain true to its own DNA and authenticity, while benefiting from the consolidated operational, production, and commercial platform of the Prada Group.

The role of the Versace family in the new environment

Although Donatella Versace stepped down as creative director at the end of March 2025 and was appointed Chief Brand Ambassador, she still maintains influence, especially in image and campaign strategy—her presence is already evident in the 2025 collections.

New Creative Director – Dario Vitale

Since April 2025, the role of creative director has been held by Dario Vitale. Born in 1983 and a graduate of Istituto Marangoni, he was previously associated with Dsquared2 and Bottega Veneta, and since 2010 has worked at Miu Miu as design director and head of image. His appointment marks the beginning of a new era of creativity. His first project, ” Versace Embodied,” blends photography, poetry, film, and art, tapping into the brand’s emotions and identity more than traditional collections.

Brand operational data

Although specific figures are not provided in the sources, it is estimated that Versace employs around 1,500 people and operates over 200 boutiques worldwide —these numbers reflect the brand’s global operational scale and significance in the luxury segment.

Transaction value: EUR 1.25 billion (Enterprise Value)

Prada Group’s shareholding: wholly owned (100%)

Number of boutiques: over 200 (operational estimate)

Number of employees: approximately 1,500 (operational estimate)

Year founded: 1978 (founded by Gianni Versace)

What does this mean in practice?

- Full control by Prada enables the integration of logistics, production, and commercial operations, which can quickly boost operational efficiency.

- Coexistence of brand DNA – maintaining Versace’s creative independence while leveraging Prada’s organizational support enables the fusion of heritage with process professionalization.

- Creative freshness brought by Vitale, supported by Donatella’s presence as ambassador, will generate new campaigns and narratives, backed by strong emotional and artistic foundations.

- Robust operational infrastructure – Prada’s global network and structures can enable faster and more consistent scaling of Versace’s operations.

The conclusion of this section does not end the story—in fact, it raises practical questions about how this new configuration will translate into real actions, brand culture, and everyday logistics. This will be the focus of the next section.

Quo vadis, Versace? Prospects after the acquisition

After Versace was acquired by the Prada Group in spring 2025, a new chapter in the strategy and development of this iconic brand begins. On one hand, this move strengthens its potential through operational and creative synergies; on the other, it brings risks related to integration and safeguarding brand identity. Below are the key trends and scenarios for the coming years.

- Possible synergies with the Prada ecosystem

- Joint ESG initiatives can benefit from Prada’s expertise in sustainability and its robust operational infrastructure.

- Digital fashion and presence in the metaverse open up new ways to engage customers – Prada can support Versace with advanced technological and marketing tools.

- Market trends

- The luxury segment in Asia continues to grow, creating opportunities for expansion—especially for Versace, whose aesthetic resonates well with local clientele (particularly younger customers).

- K-pop and image ambitions: a potential collaboration with a figure like Hyunjin could attract the favor of younger audiences.

- The metaverse as a new marketing space: immersive shows and digital collections can enhance Versace’s innovative image.

- Controversy surrounding the campaign with Dylan Mulvaney (2025)

- The campaign involving Dylan Mulvaney sparked mixed reactions—some consumers supported it, while others were critical. This can affect both brand image and sales, depending on the region and market segment.

- Reputational risk requires careful message management and transparency.

Three scenarios for five years

| Scenario | Description | Probability |

|---|---|---|

| Optimistic | Synergies with Prada are running smoothly; sales are growing in Asia and online; ESG and digital fashion are strengthening the brand. | Medium |

| Basic | Moderate growth; operational and cultural obstacles slow integration; identity preserved. | High |

| Pessimistic | Cultural conflicts; rising debt costs; image controversies limit growth. | Low |

The conclusion of this section should not serve as a summary, but rather as a catalyst for reflection. Prada has a unique opportunity not only to revitalize Versace, but also to redefine luxury in the digital and global era. Which model of sustainable growth and expansion best aligns with the ambitions of both brands?

Mark XX

High Class Fashion editor